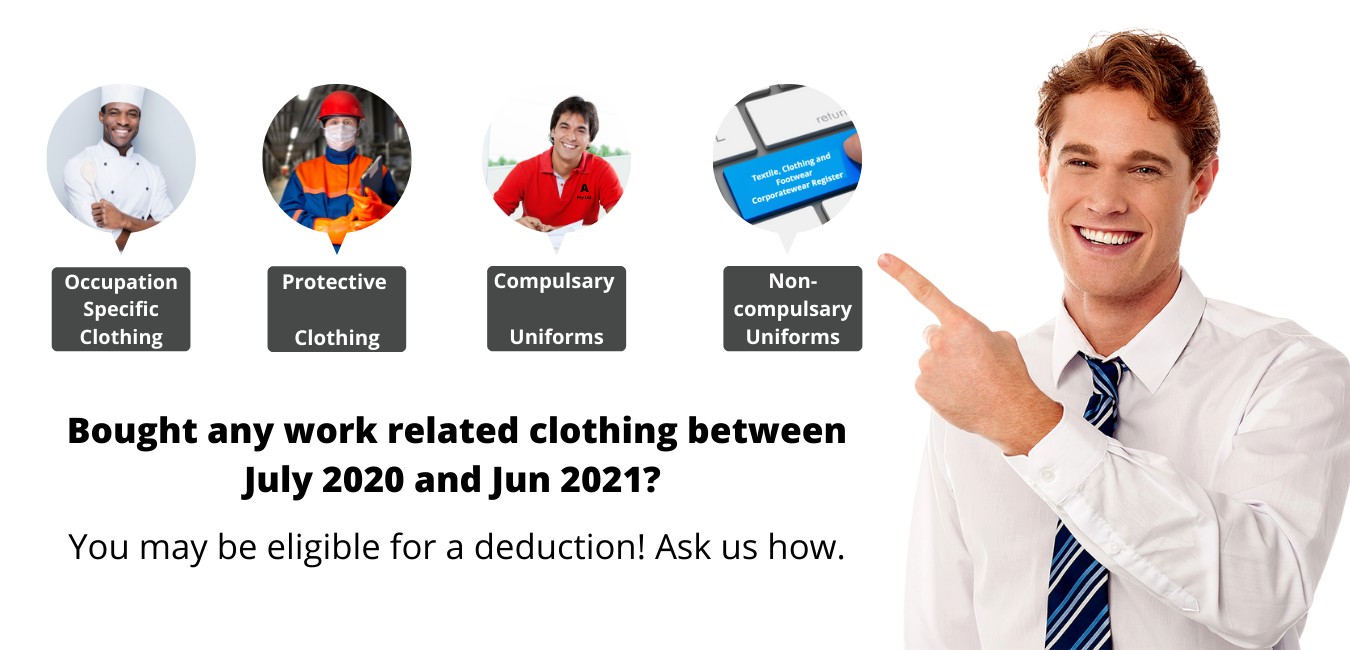

Did you know that clothing expenses that you incur for your work-related activities can save your taxes! You can claim a deduction for the cost of purchase and cleaning expenses for the following types of clothing:

- Occupation-specific clothing;

- Protective clothing;

- Compulsary uniforms; and

- Non-compulsary uniforms.

Types of Clothing Expenses

A claim can be made for the purchase and cleaning of occupation-specific clothing i.e. clothes that you wear while on a job which help people in recognising your occupation such as chef clothing in case you are a chef.

A claim can be made for clothes that help you protect from the risk of illness or injury which you are exposed to while performing your job like fire-resistant, sun-resistant clothing, rubber boots, and, so on. But for the clothing to be considered as protective, it should provide you sufficient protection from the risk of illness or injury.

If your organization has mandated to wear a distinctive uniform while performing the job, you can claim compulsory uniform expenses for shoes, socks, and stockings. A claim can’t be made for purchasing or dry cleaning plain uniform i.e. which is not unique or distinctive to the organization in the sense that it isn’t specifically designed for the organization and doesn’t contain company’s logo.

Non-compulsary uniforms may also be claimed if your employer has registered with AusIndustry. This means that the uniform must be on the ‘Register of Approved Occupational Clothing’ and you must wear the uniform at work. However, this cannot include items such as shoes, socks, stockings and single items such as a jumper.

Deduction for Cleaning Expenses

An employee can claim for costs incurred on washing, ironing, drying, and dry-cleaning eligible work clothes. For making a claim, written evidence like diary entries and receipts should be there if below condition prevails:

• Claim amount exceeds $150.

• Your total work-related expenses claim is more than $300 which does not include car, meal allowance, award transport payment allowance, and travel allowance.

If the above conditions are not there then you do not need to provide written evidence but can claim on a reasonable basis. A reasonable basis for working out the cleaning expenses shall be as below:

- $1 per load if the load relates to only work-related clothing.

- 50 cents per load if the load includes work as well as other clothing.

ATO may ask you to explain the basis that you chose if some other basis is chosen.

Deductions for Dry-cleaning Expenses

Dry cleaning for work-related clothing can be claimed and it should be supported by written evidence if total work-related expenses claim is more than $300 which does not include car, meal allowance, award transport payment allowance, and travel allowance.

Evidence required for work related clothing expenses

You need to maintain written evidence that can vouch for expenses incurring on buying and cleaning clothes. Written evidence is compulsory when both of the below conditions apply:

- Claim amount exceeds $150.

- Your total work-related expenses claim exceeds $300.

If your employer provides you allowances for uniform, clothing, or dry cleaning, you must disclose it as an income in your tax return. Further, you can claim only the expense that you actually spent.