COVID-19 truly has impacted all aspects of human life since early 2020. However, there are some positive changes that have come as a result of it as well. One of these include the rapid rise in the ‘retail investor’. This new term refers to novice investors who invest in their own time outside of their everyday work hours. Outside of their superannuation, recent studies show that 49% of all Australians own shares as of March 2021 with 13% of all Australians having invested for the first time ever since COVID-19 began.

However aside from learning how to invest in Cryptocurrency, Stocks, Bonds, Real Estate or other options, investors also need to learn about the Tax implications.

Well, with the Financial Year 20-21 having drawn to a close, in this article we will be covering ‘Capital Gains Tax’. We will be covering:

- What is a Capital Gain or Capital Loss?

- What is Capital Gains Tax (CGT)?

- When does the Capital Gains Tax apply?

- The Capital Gains Tax Event (CGT Event)

- How much Capital Gains Tax do you have to pay?

- Reducing your Capital Gains Tax

- Recordkeeping

- Capital Gains Tax Caculator

What is a Capital Gain or Capital Loss?

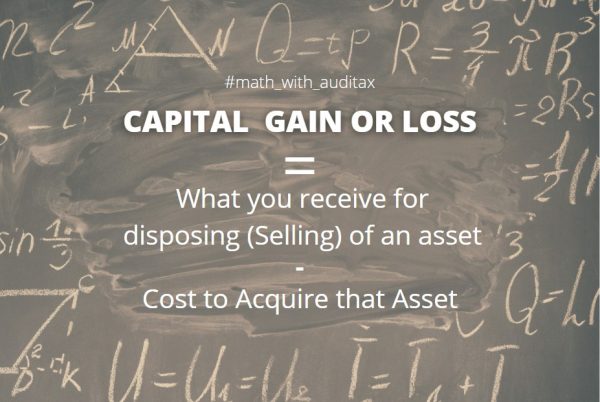

We need to first understand the concept of Capital Gain or Capital Loss before we can talk about Capital Gains Tax. Capital Gain/Loss is an economic concept that refers to the profit earned or loss incurred on the sale of an asset as the difference in value over the period of time. Capital Gain or Loss can arise on the sale of any of tangible assets such as business, property, shares, investments, etc.

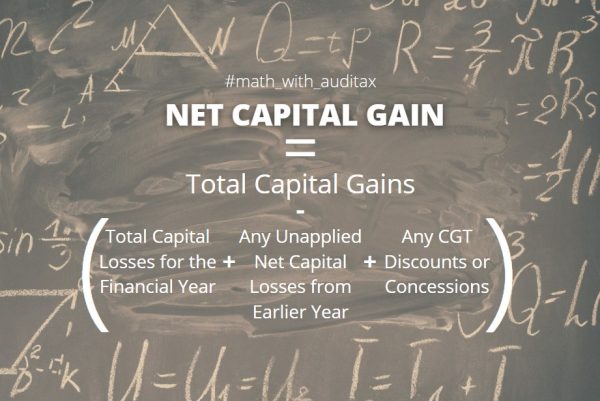

Capital Gain is when you have a profit according to the equation above and vice-versa, a Capital Loss is when you make a loss. Your Net Capital Gain is your Total Capital Gains minus:

- Your Total Capital Losses for the year; and

- Any Unapplied Net Capital Losses (from earlier years); and

- Any CGT discounts and small business concessions to which you may be entitled.

What is Capital Gains Tax?

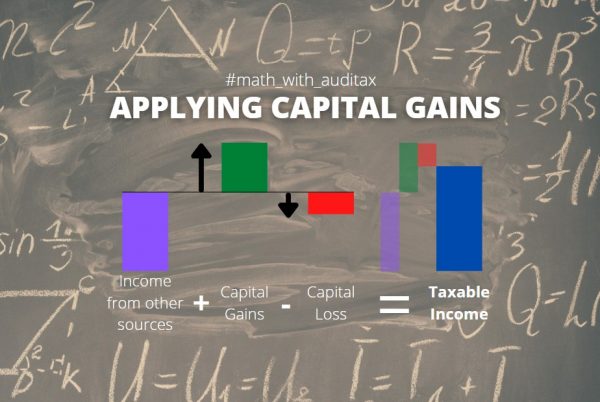

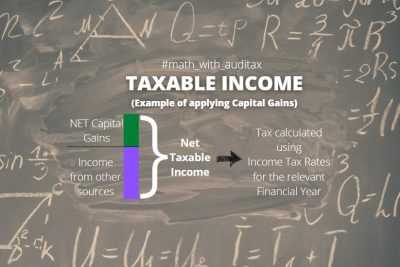

Capital Gains Tax or CGT is paid as part of your Income Tax through your Tax Return on the Net Capital Gain made by an investor. This is important because your total taxable income for the year will be all other sources of income plus your net Capital Gains. So, you will have to include any Capital Gains you made during the Financial Year at the time of filing your income tax return and deduct any Capital Losses from that gain.

Note: This figure is oversimplified as other factors may also apply. For example, costs incurred when selling an asset may be deductible from the Capital Gain you make as well.

Unfortunately though, whilst Capital Losses can reduce your Net Capital Gain in the Tax Return, they cannot be claimed against other sources of income such as salary or business income. For example:

- Sarah has bought and sold 2 shares over the previous financial year. She held as an investment and made a profit of $300 on Stock A and a loss of $100 on Stock B. She can deduct the $100 Capital Loss from her Capital Gain of $300. As her salary from her day job is $70,000 p.a., she will be paying tax on a total income of $70,200.

- Bob has bought and sold 2 shares over the previous financial year and had a total loss of $300 on both stocks. He did not have any other Capital Gains for that year, therefore, he is not eligible to deduct that $300 from his other sources of income. As his salary from his day job is $70,000 p.a., he will be paying tax on a total income of $70,000. The Capital Loss of $300 may be carried forward to the next financial year however we will cover that a bit later in this article.

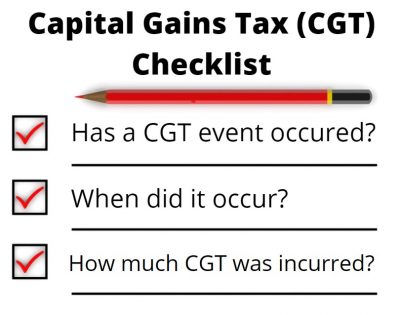

Understanding your CGT implications is a 3 step process:

When does Capital Gains Tax apply?

An easy way to understand when CGT is applicable is when you make a capital gain or a capital loss on the sale of an asset. All assets you have purchased or inherited since 20 Sep 1985 (when CGT started) are subject to Capital Gains Tax unless specifically excluded. You may check out the ATO’s extensive list here however in general, exemptions include Capital Gains or Losses for:

- Your main residence;

- Your personal vehicle;

- Personal use items bought for less than $10,000; and

- Winnings or losses from gabling, a game or a competition with prizes;

- Pre-CGT Assets (any asets bought or inherited before 20 Sep 1985).

In the next section, we will discuss how much Capital Gains Tax you have to pay and also later on about how can you reduce the amount of Capital Gains Tax liability in Australia.

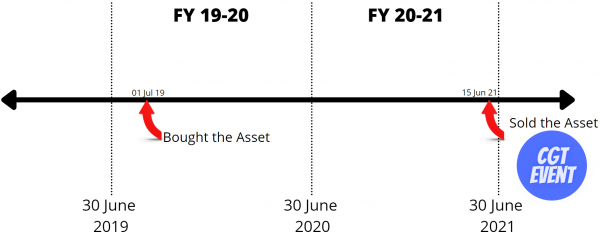

When was the Capital Gains Tax incurred?

The timing of when a CGT event occured is important because that determines which Financial Year you report the Capital Gain or Loss in. Usually, a Capital Gain or Loss is incurred (the ‘CGT Event’) when you enter into the contract of disposal (sale). For example, when you sign the contract to sell a house (as opposed to the settlement date). If there is no contract, the CGT event is generally when you stop being the asset’s owner.

In some circumstances, you may be eligible to “roll-over” a Capital Gain or Loss from a CGT event until another CGT event occurs. These are usually quite complex cases so contact us to find out more!

Contact Us

How much Capital Gains Tax do you have to pay?

The calculation itself for Capital Gains Tax is actually quite easy. Once you have calculated your Taxable Income (Net Capital Gains + Income from other sources), you will pay the applicable amount of tax for that Income Tax bracket same as you would for ordinary income (e.g. salary).

Here is an example for paying Capital Gains Tax for investing in cryptocurrency:

- Josh bought $1000 of cryptocurrency over the Financial Year and sold it for $10,000.

- In addition to investing, he also earns $40,000 from his day job. His employer has deducted $4,142 in PAYG (Pay-as-you-Go) taxes throughout the year.

- In his Tax Return, he will have to report $40,000 in income from his job and a Net Capital Gain of $9,000 ($10,000-$9,000).

- Therefore, his Taxable Income before any other deductions on his Tax Return will be $49,000 ($40,000+$9,000).

- We then find that he can claim a further $2,000 in work related expenses in his Tax Return. For simplicity’s sake, let us assume all other deductions are NIL (usually we also claim other expenses such as commission paid for the sale of the asset).

- Therefore, his Net Taxable Income will be $47,000. Tax on this income is $5,742.

- As he has already paid $4,142 in taxes through the year, he will only have to pay $1,600 in Tax as a result of the Net Capital Gain from the sale of his cryptocurrency.

If you want to find out more about how we calculated the Tax payable, here is a handy video that shows how you can calculate the Tax you have to pay on your Taxable Income:

Reducing your Capital Gains Tax

There are a lot of scenarios which allow you to reduce your Capital Gains Tax or eliminate the liability all together. Here are a few:

50% Capital Gains Discount

If you own an asset for 12 months or longer (#HODL), you will be eligible to use the Discount Method of calculating the Capital Gain in the following circumstances:

- You’re an individual, trust or complying super fund; and

- The CGT event occured after 11:45 AM (Canberra Time) on 21 Sep 1999 (weird dates right!); and

- You acquired the asset at least 12 months before the CGT event; and

- You do not choose the indexation method (read on to find out about this).

This method will allow individuals and trusts to reduce their Net Capital Gain by 50% before including it in your Taxable Income and complying superannuations funds to reduce it by 33.33%. So buy and #HODL for that 50% discount!!

Indexation Method of Calculating Capital Gain

If you acquired an asset before 11:45 AM (Canberra Time) on 21 Sep 1999 and owned it for 12 months or more, you can increase the buying cost of the asset by the Consumer Price Index (CPI) through the Indexation Method. This in effect, would reduce your Net Capital Gain. For example, if you acquired a house for $40,000 in 1995, the RBA calculator shows that in 2020, the inflation adjusted figure would be $71,446.15. Thus, if you sold your house in 2020 for $100,000, you would use the inflation adjusted figure when calculating your Net Capital Gains Tax.

Fun Fact: You can also use the Indexation Method of Calculation you find that it gives you a better result than using the 50% Discount Method! However, you may only use one of those methods when calculating your Net Capital Gain.

Costs that reduce your Net Capital Gain

The following 5 types of costs increase your cost base (cost of buying the asset) and as a result, reduce your Net Capital Gain added to your Taxable Income:

- Money paid or property given for the CGT asset; or

- Incidental costs or costs related to acquiring the CGT asset; or

- Cost of owning the CGT asset; or

- Capital costs spent to increase or preserve the value of the CGT asset; or

- Capital costs spent to preserve or defend your title or rights to the CGT asset.

Superannuation and Capital Gains Tax

You can also reduce the Capital Gain Tax Liability legitimately if you decide to contribute the capital gain money earned by you on the sale of the asset to tax-deductible superannuation funds. This option may help you in reducing and sometimes even eliminating the capital gain tax liability altogether. However, there are various conditions that apply and this process can get quite complex, message us to find out more!

Recordkeeping

!!!KEEP YOUR RECORDS!!!

We cannot stress this enough! You need to keep good records of any assets you have bought or sold so you can correctly work out the amount of Capital Gain or Capital Loss you have made and when the CGT event occured. In addition to this, you must then keep these records for five years after the CGT event occured. You should also keep records relevant to a Net Capital Loss that you carry forward as part of unapplied Net Capital Losses. You may be able to apply this Capital Loss against a Capital Gain in the proceeding Financial Year.

Capital Gains Tax Calculator

You can use our handy calculator below to calculate an estimate of your applicable Capital Gains Tax.

Please enter the amounts on the left. The calculator will update automatically.

Taxable Income |

$ |

Calculated Tax |

$ |

Tax Payable | $ |